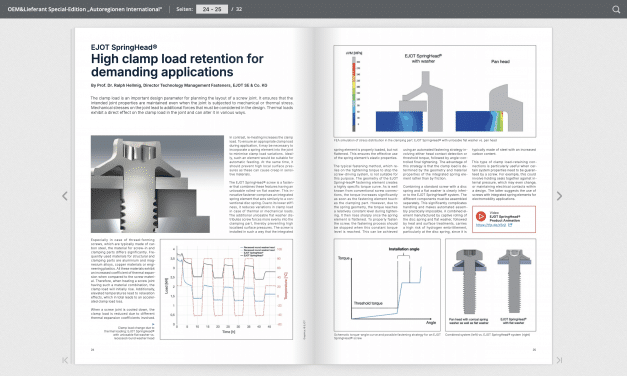

Protection for exterior components made of light metals

Exterior components made of light metals such as aluminum or magnesium have become an integral part of modern vehicle designs. At the same time, they are exposed to high levels of corrosion and environmental influences in...

Read More